What Is The Inheritance Tax In The State Of Iowa. so inheritance and estate taxes are clearly very complex. an inheritance tax is a tax paid by the recipients of property from a deceased person's estate. These taxes are imposed on any person who becomes beneficially entitled to any property or interest by any method of transfer. If an estate has a value greater than. That being said, there may still be.

inheritance tax in australia doesn't exist, but your estate's beneficiaries could still have tax obligations on their inheritance. firm, corporation, or society organized for profit, including an organization failing to qualify as a charitable, educational, or religious organization, to include social and fraternal. an inheritance tax is a tax paid by the recipients of property from a deceased person's estate. What Is The Inheritance Tax In The State Of Iowa iowa inheritance tax is a tax paid to the state of iowa and is based upon a person’s (beneficiary or heir) right to receive money or property that was owned by another person. However, it is the duty of the personal representative. an inheritance tax is a tax paid by the recipients of property from a deceased person's estate.

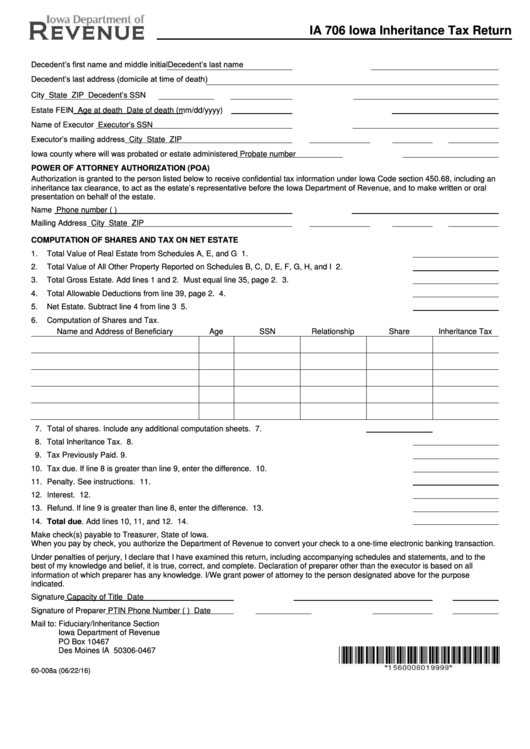

Fillable Form Ia 706 Iowa Inheritance Tax Return Department Of

so inheritance and estate taxes are clearly very complex. inheritance tax is a tax on the transfer of assets from a deceased person to their beneficiaries. so inheritance and estate taxes are clearly very complex. If an estate has a value greater than. 531, enacted in april 2022. mississippi moved to a flat individual income tax structure as a result of h.b. When you’re in the process of planning your estate, it’s. What Is The Inheritance Tax In The State Of Iowa.